Forensic Accounting and Investigative Solutions: Protecting Your Business from Financial Crimes

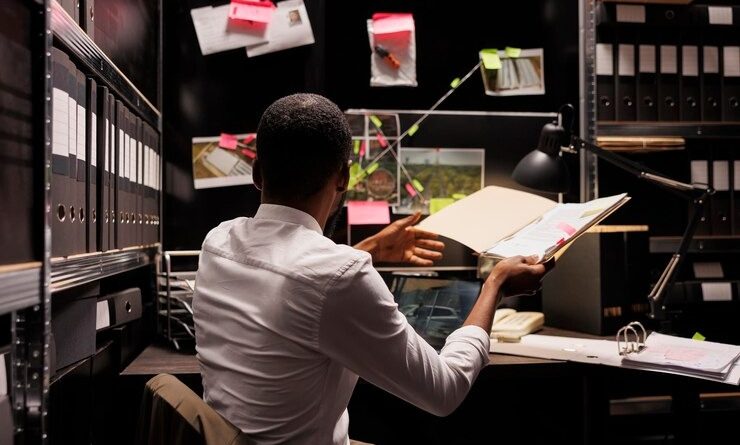

Today’s businesses and organisations are constantly threatened by financial crimes, such as embezzlement, fraud, and money laundering. Financial crimes can result in significant financial losses and reputational damage for businesses. Therefore, businesses must take proactive measures to prevent financial crimes from occurring. This is where forensic accounting and investigative solutions come into play.

Forensic accounting and investigative solutions are critical tools used to detect and prevent financial crimes. It is a process of identifying, investigating, analysing, and presenting financial information for legal proceedings. Forensic accountants work in various contexts, including law enforcement, regulatory bodies, corporate investigations, and litigation support. This article will discuss forensic accounting, the types of investigative solutions available, and the advantages of using forensic accounting and investigative solutions.

What is Forensic Accounting?

Forensic accounting uses accounting and investigative skills to investigate financial fraud, embezzlement, and other irregularities. Forensic accountants use their expertise to analyse financial data, uncover fraud, and present evidence in legal proceedings. Forensic accounting has expanded in recent years, with the growing need for businesses and organisations to identify and prevent financial crimes.

Forensic accountants work in several areas, including:

Litigation support

Forensic accountants provide support to legal professionals in disputes and litigation. They use their skills to analyse financial data, investigate transactions, and provide expert testimony in court.

Investigations

Forensic accountants investigate financial crimes such as misappropriation, swindling, and money laundering. They use their skills to trace the money flow, identify the perpetrators, and help recover assets.

Compliance

Forensic accountants help businesses and organisations comply with regulations, such as anti-money laundering regulations and the Foreign Corrupt Practices Act (FCPA).

Types of Investigative Solutions

Forensic accounting and investigative solutions include a range of services and techniques, including:

Fraud Risk Assessments: Fraud risk assessments are used to identify the risks and vulnerabilities of an organisation to financial crimes. Forensic accountants use their expertise to assess the organisation’s internal controls, policies, and procedures and identify potential risk areas.

Financial Investigations: Financial investigations involve collecting and analysing financial data to uncover fraudulent activities. Forensic accountants use their expertise to investigate transactions, trace money flow, and identify financial crime perpetrators.

Asset Tracing: Asset tracing is tracing the flow of funds or assets from their origin to their final destination. Forensic accountants use their skills to identify and locate assets that have been concealed or misappropriated.

Expert Witness Testimony: Forensic accountants can provide expert testimony in court on financial matters, including financial crimes, bankruptcy, and insurance claims. They use their skills to analyse financial data, prepare reports, and present evidence in court.

Advantages of Forensic Accounting and Investigative Solutions

Forensic accounting and investigative solutions provide several advantages, including:

Identifying and Preventing Financial Crimes

Forensic accountants can help businesses and organisations identify and prevent financial crimes by analysing financial data and identifying potential risk areas. Businesses can avoid significant financial losses and reputational damage by detecting fraudulent activities and implementing strong internal controls. Forensic accountants can also help enterprises develop risk management strategies and conduct internal audits to detect fraud and other financial crimes.

Recovering Misappropriated Assets

In cases where financial crimes have occurred and assets have been misappropriated or concealed, forensic accounting and investigative solutions can help businesses recover those assets. By tracing the flow of funds and identifying the assets, forensic accountants can help recover them. This can result in significant financial recoveries for business advisors and help them recover from the losses from financial crime.

Legal Support

Forensic accounting and investigative solutions can provide businesses with legal support by analysing financial data and providing expert testimony in legal proceedings. This can help businesses build a strong legal case and protect their interests. Forensic accountants can also assist with dispute resolution and provide support during regulatory investigations.

Compliance

Forensic accounting and investigative solutions can help businesses comply with regulations and prevent financial crimes. By identifying potential risk areas and implementing strong internal controls, companies can prevent financial crimes and comply with regulations. Forensic accountants can help businesses implement compliance programs and conduct training to ensure employees understand financial crime risks and how to avoid them.

Conclusion

Forensic accounting and investigative solutions are critical tools used to detect and prevent financial crimes. Forensic accountants use their expertise to analyse financial data, investigate transactions, and provide expert testimony in legal proceedings. The various investigative solutions available, such as fraud risk assessments, financial investigations, asset tracing, and expert witness testimony, can help organisations identify and prevent financial crimes, recover assets, provide legal support, and comply with regulations.

In today’s business environment, the risks of financial crimes are significant, and businesses need to take proactive measures to protect themselves. The advantages of using forensic accounting and investigative solutions include identifying financial crimes, recovering assets, providing legal support, and complying with regulations. Organisations can avoid significant financial losses and reputational damage by detecting and preventing financial crimes. By identifying areas of risk, detecting fraudulent activities, and implementing strong internal controls, businesses can prevent financial crimes and comply with regulations. Forensic accounting and investigative solutions provide organisations with the knowledge and expertise to safeguard their financial assets and reputations.