Tips and Methods for Using the NinjaTrader Footprint Chart Effectively

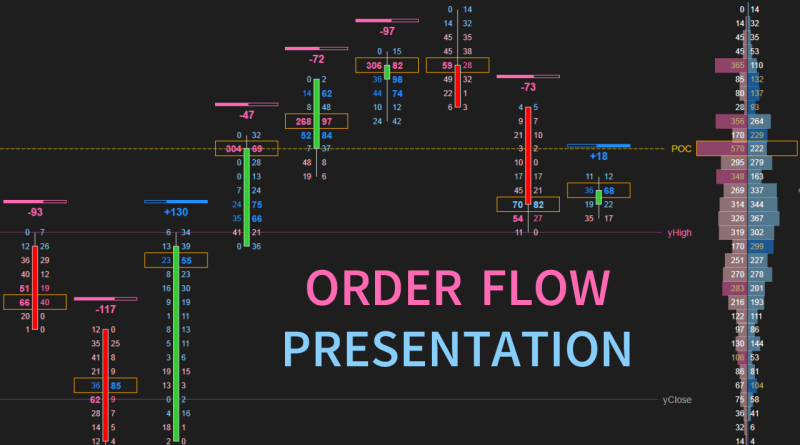

A NinjaTrader footprint chart is a trading tool that shows the quantity traded at each price index over a specified period. Offering a visible depiction of the buying and selling activity within the market enables traders to look at the order flow and enhance their decision-making abilities.

A footprint chart’s value in trading comes from its capacity to spotlight obscure market trends and patterns. Traders can also pinpoint regions of support and resistance as probable market turning points by watching the quantity transacted at various price points. Using this data, trading techniques are often made more profitable by identifying the simplest times to enter and exit deals.

Tips and methods for using the NinjaTrader footprint chart effectively.

For examining market activity, the NinjaTrader footprint chart is an efficient tool.

- Learn the basics first to use it properly. You’ll observe where there’s intense buying and selling pressure by watching the quantity traded at each price index on the chart. This will assist you in locating important levels of support and resistance, as well as regions where the worth will reverse. Furthermore, note the chart’s color coding, representing the extent of shopping for or selling activity. You’ll increase your trading success and make better judgments by integrating these insights with your current trading methods.

- Apart from comprehending the basics, there exist some tactics that will improve your utilization of the NinjaTrader footprint chart. First, examine the quantity profile for trends and abnormalities. A notable surge in volume at a specific price point, as an example, can point to a high degree of support or resistance. Likewise, an abrupt drop in volume can portend a break-even point within the market or a scarcity of interest. By recognizing these patterns, you’ll predict market changes and modify your trading strategy.

- Another helpful tactic is analyzing the order flow data that the footprint chart provides. You’ll determine if buyers or sellers are on top by watching the info, which displays the order of trades at each price point. By keeping an eye fixed on the order flow,

- You can identify imbalances and predict market direction changes by observing the order flow. For example, a string of strong buy orders at a particular price point can point to a positive trend. On the other hand, a variety of sell orders will indicate a downward trend. You’ll improve your chances of success by placing your trades in line with the dominating order flow.

Conclusion

NinjaTrader footprint chart offers a radical understanding of the quantity and order flow exchanged at various price points, making it a valuable tool for traders. By examining this data, traders can detect market trends, synchronize their transactions with institutional traders, and make better trading decisions. Traders wishing to assess market data properly must comprehend the salient characteristics of NinjaTrader’s footprint chart. Through data interpretation and pattern analysis, traders can acquire important insights into the market dynamics. The NinjaTrader footprint chart is a powerful tool for traders, providing valuable insights and opportunities for informed decision-making. The NinjaTrader footprint chart is useful for traders seeking to grasp market dynamics on a deeper level. You’ll use this chart to your advantage to form more intelligent trading selections if you understand the basics and put good methods into practice. Always look at volume profiles, spot trends, and monitor order flow to enhance your trading performance.